6-minute read

Many of our clients are investment professionals working in the health and human services space (including the full spectrum from angel to VC to equity firms). The article below is based on our experience working with investors who have succeeded in this space.

Risk 1: Failing to understand that seeking revenues in the Health and Human Services (space) creates a new set of challenges for your portfolio companies

One of the worst mistakes investors new to the space can make is to assume that strategies rooted in the commercial payer or Medicare Advantage space can be simply pivoted into the Medicaid space. The mistake is understandable, because few portfolio companies understand this risk and they do not know to communicate it to their investment partners.

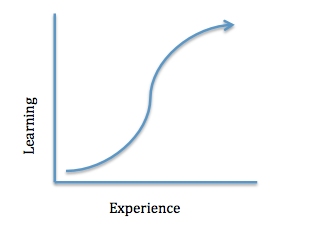

Risk 2: Underestimating the Learning Curve

Understanding that commercial and Medicare strategies need to be dramatically altered to work in Medicaid is the first step. The next risk is underestimating the learning curve for Medicaid. Each state operates its own Medicaid program, and most benefit, operational and procurement decisions are done independent from federal operations. We have a saying in our space: “If you have seen one Medicaid program, you’ve seen one Medicaid program.” Besides the policy differences across states, each state has its own agency and stakeholder environment, and navigating these is extremely complex for HHS veterans. Finally, the regulatory environment for this space evolves constantly, and in ways that greatly impact revenue projections. For those new to the space, critical mistakes and loss of time are guaranteed.

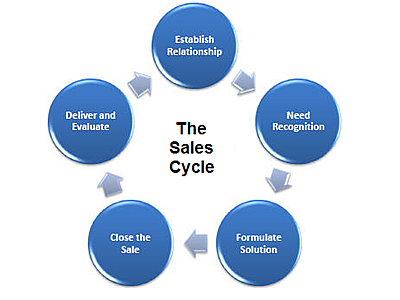

Risk 3: Miss the Unique Complexity of the HHS Sales Cycle for Your Portfolio Companies

Many investors rely on the relational nature of other verticals for confidence in sales revenues. While relationships play an important role in the HHS space, most contracting is done using a defined competitive procurement process. This applies to both state agency and health plan contracts (though less so in health plans). Because of the regulatory and bureaucratic components, the sales cycle for this space is much longer and much more unpredictable than in other verticals.

Risk 4: Differences in pricing models

The Medicaid space has two key components that drive unique pricing models: A focus on the rate-cell capitation payments to managed care plans, and long-standing efforts to implement value-based payment models.

Medicaid health plans are paid a per member per month (pmpm) fee by states to manage different populations (such as diabatics or pregnant mothers). All the costs for care and management of each member must be funded by those rates or the plan loses money. Each plan thus thinks of all vendor solution costs in terms of pmpm. This type of pricing is not the norm for most portfolio companies operating in the commercial space, and it may take a large effort to structure pricing models in a way that will succeed in the Medicaid space. Most portfolio companies price solutions at an aggregate level and do not have a way to assign costs at the plan member level.

The second challenging part of HHS pricing models is the focus on value-based payments. Most Medicaid state agencies and health plans are required to place an ever-increasing amount of their payments to providers in what is called a “value-based” arrangement. While precise definitions of these models remain elusive, the critical risk is not being able to clearly tie a portfolio company solution to specific member outcomes. Vendors should also be prepared with standard risk sharing arrangements to offer to prospects in the Medicaid space.

How You Can Address The Risks of Investing in the HHS Space

In addition to your own research into this vertical, there are a few key tactics that can help you overcome some of the common challenges in the space.

- Engage a consulting firm with deep expertise in the space, but that also has a practice area focused on assisting investment professionals. We provide this type of assistance to our investment clients, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

- Consider adding a vertical-specific market intelligence product to your toolkit. While there are multiple options for general investing market intelligence in the healthcare space, if you are considering (or already executing) an investment thesis tied to HHS-vertical revenues, the more specific your research sources, the better.