MM Curator summary

Montana is one of several states looking to reduce fraud in food stamps and related benefits programs, and Democrats oppose the effort.

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Montana is considering becoming the latest state to aggressively check welfare eligibility to cut costs. While supporters of the move say it’s about what’s fair, opponents say it will impact enrollees who need help, especially amid the pandemic. (Matt Volz / KHN)

Montana is considering becoming the latest state to intensify its hunt for welfare overpayments and fraud, a move expected to remove more than 1,500 enrollees from low-income health coverage at a time when the pandemic has left more people needing help.

With Republicans now controlling both chambers of the Montana legislature and the governor’s office, a lawmaker is reviving an effort to both broaden and increase the frequency of eligibility checks to search for welfare fraud, waste and abuse. Proponents say it’s about what’s fair — weeding out people who don’t qualify, protecting safety nets for those who do, and saving the state millions. But advocates for low-income people who rely on such services and some policy analysts say such changes would unfairly drop eligible people who need the aid.

“We’re not looking to do anything mean. We’re taking the emotion out of it,” state Sen. Cary Smith, a Republican, said during a Jan. 20 hearing on his bill, the Provide for the Welfare Fraud Prevention Act. “If you don’t qualify, then you shouldn’t be participating in that program.”

The Montana bill, and measures underway in Ohio and Utah, are similar to earlier efforts undertaken to cut costs in states such as Illinois and Michigan. But this year’s bills come even as Congress offers states more Medicaid dollars if they ensure people have continuous coverage through the pandemic because of its economic shock waves.

Don’t Miss A Story

Subscribe to KHN’s free Weekly Edition newsletter.

The Montana proposal would create a system potentially run by third-party vendors that would mine a large swath of data to see if someone, for example, has assets like a boat, has won the lottery or has filed for benefits in another state. The vendor could earn a bonus for flagging more cases than the state projected. State employees would have the final say in cutting someone from Medicaid, the Children’s Health Insurance Program, food stamps or other aid programs.

The state estimates the measure could save Montana’s treasury between $1.4 million and $2.3 million each year over the next four years by dropping more than 1,500 people on Medicaid and 277 children covered by CHIP.

This isn’t Smith’s first effort to create such a law. He sponsored a similar bill in 2015 that was vetoed by the state’s then-governor, Democrat Steve Bullock. In the veto letter, Bullock said the measure duplicated steps the state already took and unfairly stigmatized Montanans who are poor. Opponents of Smith’s latest proposal have repeated those concerns. Smith didn’t respond to several requests for an interview.

But this time, the potential legislation has a clearer path. The state has a new governor, Greg Gianforte, a Republican who called for heightened Medicaid eligibility checks throughout his 2020 campaign.

During Montana’s first hearing for the renewed effort, Scott Centorino of Opportunities Solutions Project was the sole person to testify in support of the bill.

“I’ve seen this play out in state after state,” Centorino said. “Turns out, the less you look for welfare, fraud and waste, the less you find.”

Opportunity Solutions Project, the lobbying wing of the Foundation for Government Accountability, a right-leaning think tank, has backed similar efforts elsewhere that followed FGA model legislation. The organizations have also been major forces in trying to link food assistance to work requirements and block states from expanding Medicaid.

Opportunity Solutions Project’s attempts to influence laws at the federal level, too, appear to be growing. The nonprofit spent $25,500 lobbying the federal government in 2017 and $420,000 last year, according to the Center for Responsive Politics.

Opponents of the Montana bill have said the focus on welfare recipients is misplaced. Nationally, most Medicaid payments deemed improper last year were tied to states not collecting information that federal standards already call for, not necessarily for covering ineligible enrollees, according to a U.S. Department of Health and Human Services financial report.

Michele Gilman, a University of Baltimore law professor, said the potential bonus Montana would pay a company finding more savings than expected is especially concerning.

“The goal should not be to create some bounty hunter system to find alleged cheats that don’t exist,” Gilman said. “This is built on an unfounded mistrust of poor people and undermines public support for social programs.”

If states do move to undertake broad data searches, she said, they need to start with a pilot program to test for errors in its design. Gilman called Michigan the ultimate cautionary tale. The state, which had used a new computer program to spot cheaters, ended up mired in lawsuits after it falsely charged thousands with unemployment fraud between 2013 and 2015.

The Trump administration and federal agencies encouraged states to increase eligibility checks. According to a KFF analysis, as of January 2019 more than half of states were conducting checks more often than during annual renewals, with some doing so quarterly. (KHN is an editorially independent program of KFF.)

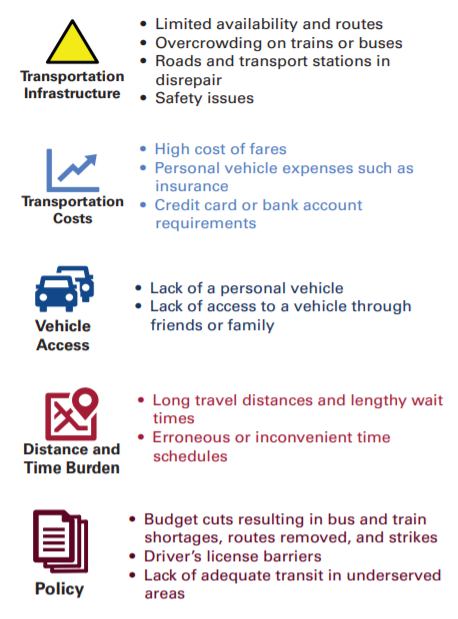

Robin Rudowitz, co-director of KFF’s Program on Medicaid and the Uninsured, said Medicaid and CHIP enrollment dropped across the nation from late 2017 through 2019. Rudowitz said it’s hard to untangle all the reasons the enrollment declines occurred, but increased verification efforts that add to administrative hurdles create barriers to coverage.

Jennifer Wagner, with the left-leaning Center on Budget and Policy Priorities, said people may not realize they’re still eligible when notified that their benefits are in question or may not even receive the notice. She said a search for benefits filed in a separate state may flag aid that can cross states, such as food stamps, and such searches can pull up property someone no longer owns. Frequent wage checks may not take into account inconsistent jobs. The onus would fall to the aid recipient to prove they are still eligible in each scenario, she said.

One state that Opportunity Solutions Project points to as a success is Illinois, which in 2012 hired a company to identify Medicaid recipients who might not be eligible. Wagner, who was an associate director with the Illinois Department of Human Services at the time of the change, said Illinois is unique because the state knew it had a backlog of status checks. Within a year, Illinois had canceled benefits for nearly 150,000 people. But the state reported that more than 75% of cancellations were due to clients’ failure to respond to a state letter asking for more information. Wagner said similar issues have occurred in other states.

“In many cases, those individuals remain eligible, but they have a gap in coverage and they have to reapply and do what they can to get back on the program,” said Wagner. “There’s a large cohort of people who never get that done.”

Of all the people Illinois dropped, nearly 20% had reenrolled by the end of the year. That issue — people getting knocked off when they’re eligible — already happens in annual renewals. But Wagner said more checks means more people losing benefits, and more work for states to bring those people back onboard.

Centorino, with Opportunity Solutions Project, said systems that remove qualified people aren’t being implemented properly, but added it’s not too heavy of a lift to respond to an eligibility question.

“The alternative is not is not resolving the discrepancy at all and just assuming that there is no discrepancy and continuing to fund benefits for somebody who may be ineligible,” he said.

In Montana, even with the bill’s clearer shot at becoming law, some elements that opponents criticized were rolled back after the state estimated it would need to hire 42 employees to run the new system. Smith reduced how many programs would fall under its scrutiny and pulled back eligibility checks to twice a year instead of quarterly. He removed a rule that the system pay for itself, and he cut a section that would have disenrolled people who don’t respond to eligibility questions or notices within 10 business days.

Nonetheless, if a new system flags issues in people’s enrollment, the state will have to go out searching for why. The bill is under consideration in the Senate and must also pass the House before it goes to Gianforte for signing.

Clipped from: https://khn.org/news/article/with-gop-back-at-helm-montana-renews-push-to-sniff-out-welfare-fraud/