Category: Uncategorized

3 tips for Medicaid Health Plans on Inviting Solution Vendors to Your Next RFP

Many of our clients are health plan professionals working in the health and human services space (including Medicaid plans and Medicare Advantage plans). The article below is based on our experience working with health plan staff who have succeeded in improving vendor management and procurement activities.

Reading Time: 3 minutes

Intended Readers: Medicaid Health Plan vendor management teams and executives

Tip 1: Invite more than you need

Its always good to have options. You should try to have at least two very strong candidates make it past the initial evaluation period. And in order to do that, you probably need at least 4 bidders to submit a proposal. And in order to have that many proposals, you probably need to invite 5 or 6 bid. Invite specific vendors you have initially vetted (versus a broad open call) when possible. This will mean more work on the front end of your procurement effort, but will lead to stronger proposals and more interested vendors.

Tip 2: Rely on references from your health plan peers

Your number one asset in this process is other health plans who have done business with the bidders. In the Medicaid space, most plan staff are less concerned about competition (except during MCO contract award cycles) and are more concerned about improving the delivery of services in the Medicaid program. Don’t be shy about asking your contacts in other plans for their opinion on vendors.

Tip 3: Hold a 1 on 1 pre-invitation discussion with each vendor

Remember your goal is high quality proposals. In order to provide those, vendors need to understand as much as they can about your goals for the project. In addition to the normal group Q&A call offered to vendors, consider offering 1 on 1 discussions to make sure vendors are aligned with your vision for the project. The number of vendors interested will dictate how much time you invest in this step. Its also recommended to conduct this part of the process with another trusted external consultant if possible. This step will minimize confusion over goals and scope before proposals are submitted, without adding even more workload to your operational staff.

How to get started implementing these tips

We assist clients with each of these strategies, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

Knowing what to do is only the first step. Knowing how to implement these tips with your current team amid many other priorities is more complex. Here are a few other pointers on improving your options for your next vendor procurement:

- Create a short list of invitees and gauge interest with them before executing your full procurement effort– List the three vendors that immediately come to mind, and have a half hour exploratory discussion with a small group from their team. This can help you rapidly identify any key changes or clarification needed to your requested project scope without the extensive resource cost of an RFI.

- Assign an existing team member to own the procurement effort from a project management perspective OR hire an external consultant to focus on the effort- If your project is not too large, or not too complex, you can assign a team member to drive key work items that are often overlooked like scheduling and action item management.

MostlyMedicaid: We can help.

5BF: 7/9/2021

EBB Program

How to get your FREE CEUs

NH State Employees PBM

What are plans doing to integrate behavioral and physical health?

Many of our clients are part of efforts to further integration of behavioral health and physical health care in a variety of different structures across the country. Whether you are a plan that is part of a state transformation effort, examining the potential for integration as a driver for quality improvement or working with providers to develop value-based payment for integrated care, there is a tremendous amount activity in this area.

Reading Time: 7 minutes

Intended Readers: Plan Executive Level Staff and integration solution providers

Key Topics: Environments, Categories of integration efforts, Operational components

Environments

The landscape of integrated care in states is varied and dynamic. There are many states that have already moved to integrate responsibility for behavioral health and physical health at the plan or community care organization level. Some others are taking steps in this direction and still others have not started to move on this particular area yet, but could begin the process at any time.

The most direct route for states to incentivize integration in their Medicaid programs is to procure the services together from a single integrated health plan. However, it is not the only way states are trying to advance integrated efforts. Some are acknowledging that there are populations within the integration effort that may benefit from special focus in a carve-out or similar structure. There are also states that have not taken concrete steps to structurally incentivize integrated care but are using existing contracts to push inclusion of all member issues in developing care plans and treatment.

Plans have to operate within the environment of the state(s) where they work. Is this state integrating behavioral health and physical health in its procurement of services? Is this state still managing the behavioral health and physical health in different plans or structures, but expecting plans to work together to advance larger goals? Is there no expectation for integration at the plan level, but, instead, opportunity for plans to work to advance integration at the provider level?

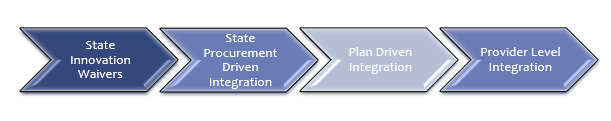

Category 1 – State Innovation Waivers (1915i)

States can bring integration efforts into the state through the use of Medicaid innovation waivers that allow them to leverage more creative payment structures to support the integration of behavioral health and physical health. Many states have done work in this area that has advanced the knowledge-base for integrated health services and identified potential avenues for further integration.

California is the most familiar example of a state pushing integration efforts through state transformation and Medicaid waivers. The CalAIM initiative is attempting to drive more integrated care, along with a combination of other initiatives. Currently, the state has a county-managed system with four different types of models. Those models do not easily facilitate integrated care, particularly when it comes to people with serious mental illness or substance use disorders.

Category 2 – State Procurement Driven Integration (1915c)

Several states have advanced integration through the procurement of health plans that are responsible for both the delivery of physical health and behavioral health services. These efforts give states direct levers to drive change and give plans flexibility in how they manage the various components of service delivery to ensure that costs remain manageable and outcomes are improved for their members.

Ohio and North Carolina have taken this procurement-driven approach in recent years, developing different delivery models, but both attempting to improve outcomes for members with behavioral health and physical health challenges and breaking down of silos between the service delivery systems. In Ohio, all behavioral helath services are now part of the responsibilities for the same plans that were previously managing physical health services. In their most recent procurement, Ohio also added a separate program to manage multi-needs children.

The State of North Carolina has gone through an extensive evolution of the management of behavioral health services – from a county-driven system, that is still in place in many states, to a regional “local managing entity” structure that brought together counties and leveraged the economies of scale, to those LME-MCOs merging and consolidating over the years, to a new model that will bring most behavioral health services under the same managed care plans who manage physical health, but individuals with more complicated behavioral health challenges being managed by “tailored” plans.

Plans that are operating under models where the state is attempting to integrate service management into its procurement of plan services have a clearer picture of what is expected and ability to deliver because of the dollars being included in the PMPM. These plans have to understand that the behavioral health provider networks are not on the same level as physical health provider networks in terms of sophistication of clinical service planning, electronic health records, documentation and claims processing. These integrated plans have the opportunity to help professionalize the behavioral health provider networks, but there is investment needed to support that work.

Category 3 – Plan Driven Integration Efforts

Plans have incentives beyond state priorities and contracts to drive integration efforts. Barriers to access, network management, utilization management and quality can also drive a need for better integrated care. These plan driven efforts can be identified through quality improvement efforts, contract compliance efforts or work in data analytics that identifies populations who are experiencing challenges that could be prevented with a more integrated service delivery system.

Category 4 – Facilitating and Supporting Provider Level Integration Efforts

At the level closest to members, plans are piloting a variety of initiatives to better coordinate and integrate care for behavioral health and physical health with hospitals, health systems, Federally Qualified Health Centers and Certified Community Behavioral Health providers. These pilot projects demonstrate a return on investment and show the value of integration in a concrete, tangible manner.

Operational Components

All of the operational areas within a plan can and should be involved in integration efforts, from the call center, to the care coordination team, utilization management, quality improvement, provider network management, data and information technology. All areas of plan operations have something to contribute to integration efforts.

How A Plan Can Enhance Its Efforts Toward Integration of Behavioral Health and Physical Health Services

Besides your own research into this topic, there are a few key tactics that can help you overcome the most common challenges related to integration of physical and behavioral health services. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be:

- Better understand the state environment for your plan – What waivers has the state requested? What waivers have been approved? What is the procurement cycle? What are the governor and legislature discussing when it comes to Medicaid? Are there other drivers for integration?

- Surface concerns your team has around integration and barriers that have been experienced in trying to advance integration efforts – An integrated care project will impact current workflows and business organization approaches. An initial listening-session series can save you a lot of time and mistakes.

- Identify projects that could advance integration in your health plan that also solve other challenges within the plan – pilots with providers, data analytics efforts and analysis of member journeys and experience – When you get into a full-scale integration project, small-wins will be important to establish momentum. And alignment with multiple objectives will be key to sustain success.

Trends in state health and human services (HHS) website design

Many of our clients are state government professionals working on the technology side of health and human services agencies. The article below is based on our experience working with professionals in this space.

Intended reader: Government staff involved in web redesign efforts

Reading time: 7 minutes

Key Topics: Why states are revamping sites, What states are doing, Best practice examples,What scope is typically outsourced, Lessons learned and challenges

Why are states revamping their HHS sites?

In the past few years, states have launched efforts to update their websites for a wide range of agencies. This includes public-facing functions such as employment offices, vehicle licenses, and tax collection offices. And now a trend has emerged with states updating the websites of their health and human service agencies. This includes Medicaid programs, but also child welfare, public health and mental health functions.

This trend is driven by 2 major factors:

- Newer technology, particularly around web architecture– This creates new opportunities for the state IT enterprise, and also creates urgency around bringing legacy systems into compliance with modern standards.

- An expectation by more of the general public for a streamlined service experience– Most Americans have come to expect a simple, helpful path towards getting what they need from all service providers (including public and private).

Newer technology

One of the main drivers for updating state HHS websites is the need to align legacy web technology and approaches with modern options. Many states developed their websites using older versions of Sharepoint, and those versions are no longer supported. Some state websites were designed to work best with very old versions of browsers. Most were designed before the general use of APIs. Some states are still hosting their websites on-premise, and are looking to move all operations to the cloud.

User expectations

Interacting with state HHS programs is only one small part of a members’ experience with technology systems. With the widespread use of internet-based services, members have come to expect a smooth technology experience that allows them to maximize what they can do for themselves (self-service). They also expect this experience to be simple and similar to what they experience in other areas of their digital life, like retail and banking.

What are states setting out to do?

States are focusing on several key areas, including:

- Enhancing the experience of users of their website (both members and program provider users)

- Streamlining presentation of existing program information

- Porting some program offline functions to an online model

- Increasing agency transparency by reporting of data and sharing copies of vendor contracts

A few best practice examples

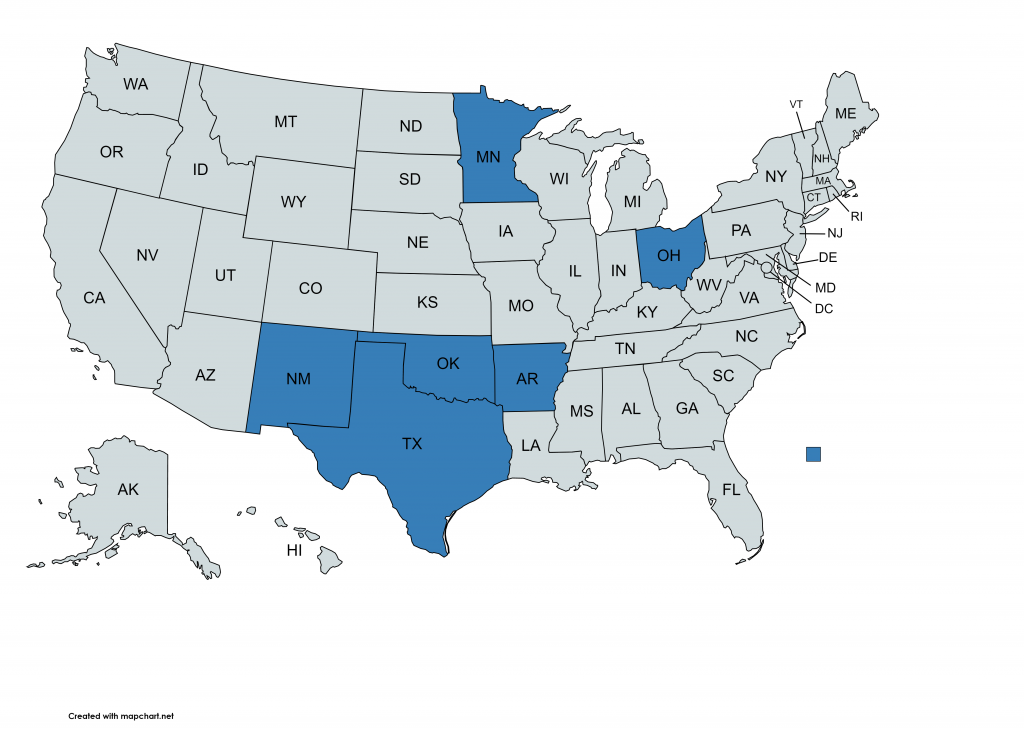

We recently reviewed 6 state websites for a best practices scan:

- Arkansas

- Minnesota

- New Mexico

- Ohio

- Oklahoma

- Texas

Based on our review, states are using their new websites to focus on several key areas of self-service and education for providers and members. The table below provides a summary of our findings.

| Functional Area | What Best Practice States are Doing with their Websites |

| Provider Enrollment & Registration | Online services provider enrollment and registration for Medicaid program and behavioral health service delivery programs |

| Licensing & Certification | Online databases and services for board managed licensures and certifications for individuals in a variety of fields. |

| WIC | Including information on requirements, eligibility, and application paths for the WIC program. |

| Vaccinations & Immunizations | Including information on required school vaccination schedules, vaccine availability, flu shot availability, vaccine registries and information for other vaccines. |

| Opioid Addiction | Including educational information on opioid misuse and overdose prevention, naloxone, data on the opioid epidemic, prescription opioid disposal, prescribing guidelines and opioid treatment programs. |

| Diabetes | Includes diabetes prevention, diabetes management, healthy lifestyles programs, information for providers on diabetes, and diabetes research. |

| Hand Offs to Local Health Departments | Includes food safety permits & inspections, HIV/AIDS programs and testing, children’s health services, and women’s health services. |

| Vital Records | Includes access to birth, death, marriage, and divorce records. |

| Prescription Drug Monitoring Program | Includes registration for pharmacist and prescribers, data, and legislative requirements. |

| Eligibility for Services | Includes eligibility for services under the developmental disabilities administration, behavioral health administration, and public health administration. |

What scope are they outsourcing? What are they doing in house?

Overhauling a website that was likely launched 20 years ago can be an overwhelming task. Most states choose to outsource several key components of the project, including:

- Project management– Key efforts include managing schedules, change management, and scheduling of state resources.

- Tech infrastructure– Key efforts include standing up a migration environment, conversion of existing code and IT assets, testing and custom development efforts.

- Content development – Key efforts include identifying priority services and user personas to use to drive site redesign, and development of test cases to be used by development team.

What are some of the lessons learned and challenges?

A lot can go wrong in a project like this. Based on what we have seen in recent projects, there are 2 critical areas to get right:

- Governance, governance, governance– Without a clear governance process, it is very challenging to move a project forward. Your project will require collaboration across many different business units. Each of those units has different goals and priorities. There will be many times that a decision will be required, and some unit priorities will be selected over another in order to move forward. Besides the internal decision process challenge, it is important to keep in mind that the overall effort centers around moving the agency to be more public facing (via an enhanced website focused on improving the user experience). As such, there will be more complexities introduced into the decision-making process. Without a clear governance process at the outset, your project will almost certainly be late and of less quality than you want.

- Have a plan for what happens after go live– So much effort goes into getting to go-live for the new site, that it is easy to miss how important the ongoing operation of the improved model is. If you do not have a plan for updating content and continuous improvement of your new site, your website will just become static and outdated again.

How You Can Address the Challenges of Updating Your State’s HHS Website

Besides your own research into this topic, there are a few key tactics that can help you overcome the common challenges related to updating HHS websites.

Besides your own research into this topic, there are a few key tactics that can help you overcome the common challenges related to updating HHS websites. We provide this type of assistance to our government clients, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

- Keep the end user experience central to your design focus. Remember, your customers are immersed in an online world outside of your website. Their online experience with social media, banking, and retail have created an expectation of self-service, speed and simplicity. In order to meet these expectations, you should engage a firm with deep expertise in the space, but that also has a practice area focused HHS website users persona development. It is critical to align technical design with real person use patterns.

- Include operational success in your initial planning. If you only plan for the design, development and implementation of your new website, you will fail after go-live. You must set your efforts up for successful and sustained operations from day 1.

- Review and update your decision-making processes (governance) related to the effort before beginning the project. You will encounter challenging decisions early on in the planning stages of the project. Investing in a shared and relevant framework for making project decisions is one of the most important things you can do for project success.

- Think about website content differently, and get assistance creating it – Most internal users (government employees) think very differently about the content that is helpful on a website compared to your external customers (members, providers, and other members of the general public). Your staff are already overtaxed with their normal duties and overall project efforts for the website redesign. Asking them to create (or repurpose) content for the site in a way that end-users will value is most likely unrealistic.

How does the sales cycle work for technology solution vendors in the Medicaid space?

Many of our clients are solution vendor professionals working in the health and human services space (including the full spectrum of solution verticals selling in this space). The article below is based on our experience working with sales teams who have best-in-class capture processes.

Reading time: 15-minutes

Intended audience: Information Technology or Solution Business Development or Governmental Affairs Team Members in HHS solution vendors companies

Key Topics: Overview of HHS/Medicaid sales cycle, Comparison to other verticals, Fee for Service vs. Managed Care, Main stages of procurement cycle, Timelines

Overview of the Medicaid industry sales cycle

This article will cover the high level overview of the sales cycle for opportunities in the health and human services (HHS) space, including:

- How the Medicaid sales cycle differs from other healthcare verticals (comparing to commercial and Medicare)

- The two major paths of the Medicaid sales cycle: Fee For Service vs managed care

- The typical procurement cycle

- Detecting opportunities pre-RFP

- Duration of RFP periods

- Delays and cancellations

How the Medicaid sales cycle is different from other healthcare verticals

One of the first things sales professionals notice about selling in the Medicaid space is that its different from selling into commercial or even Medicare Advantage environments. In the commercial space, traditional relational-selling techniques are the norm. The Medicare Advantage space can also be highly relational-selling, but brings with it the added regulatory component that makes it more similar to selling in the Medicaid space.

Selling into the Medicaid space is very different because of 2 major factors:

- Relational selling is trumped by regulatory and process acumen– While your network of contacts is important, most opportunities in this space are driven by formal procurement cycles. The sales team that is more versed in Medicaid and HHS procurement approaches will be more successful than the team with “stronger” contacts but without the Medicaid sales knowledge.

- Value propositions are complicated by a more diffuse decision-making process AND the healthcare complexity of the Medicaid population– While you may be able to engage only a few key decision makers in a commercial (or Medicare Advantage) sale, Medicaid/HHS sales will involve multiple business units inside a health plan (or government agency) and multiple levels of staff. Your sales efforts will touch the C-Suite, but will also include many other parts of the organization. This is because of the extensive regulatory environment, but also because the Medicaid member populations being served by your solutions are much more complex than those in commercial or Medicare Advantage plans.

The 2 major paths of the Medicaid sales cycle: Fee for Service vs Managed Care

Depending on the scale of your solution, you may want to sell either to state agencies or Medicaid managed care plans. (There are some instances in which both capture paths might make sense). State agencies typically make very large purchases of technology solutions that will be used by all providers in the Medicaid program in their state (such as claims processing systems). Managed care plans typically purchase solutions that will be used for the operations of their plans and programs only.

Reasons to focus your sales efforts on Medicaid managed care

Many solution vendors find the unpredictability, complexity and length of the direct-to-states sales path too difficult, so they quickly pivot into the Medicaid managed care capture path. The styles used to sell to commercial targets are also similar to those used to sell to Medicaid managed care plans. Because of these reasons, solution vendors typically focus on Medicaid managed care at least in the beginning of their Medicaid sales efforts.

Reasons to focus your sales efforts on state agencies

There are two main reasons to focus on sales to state agencies:

- Your solution is so large that it is not something a single plan (or even multiple plans) can purchase, or

- Even if your solution is not too large for a single plan buyer, you may want to sell to agencies to get your solution to be preferred or required for all managed care plans

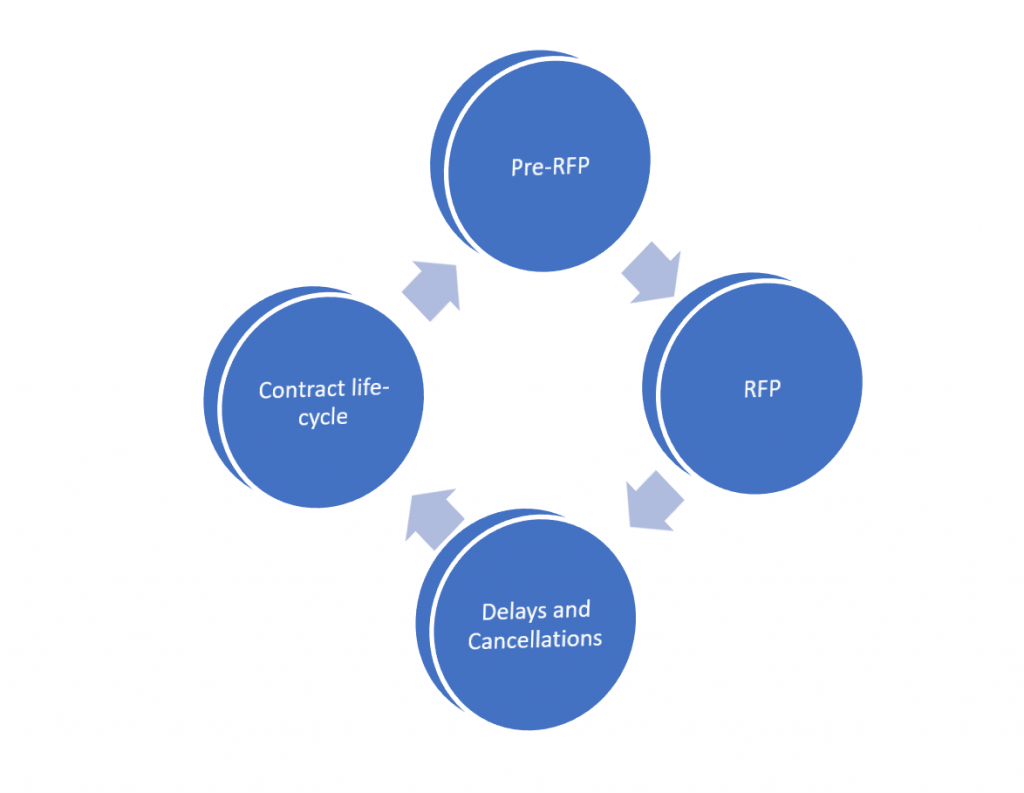

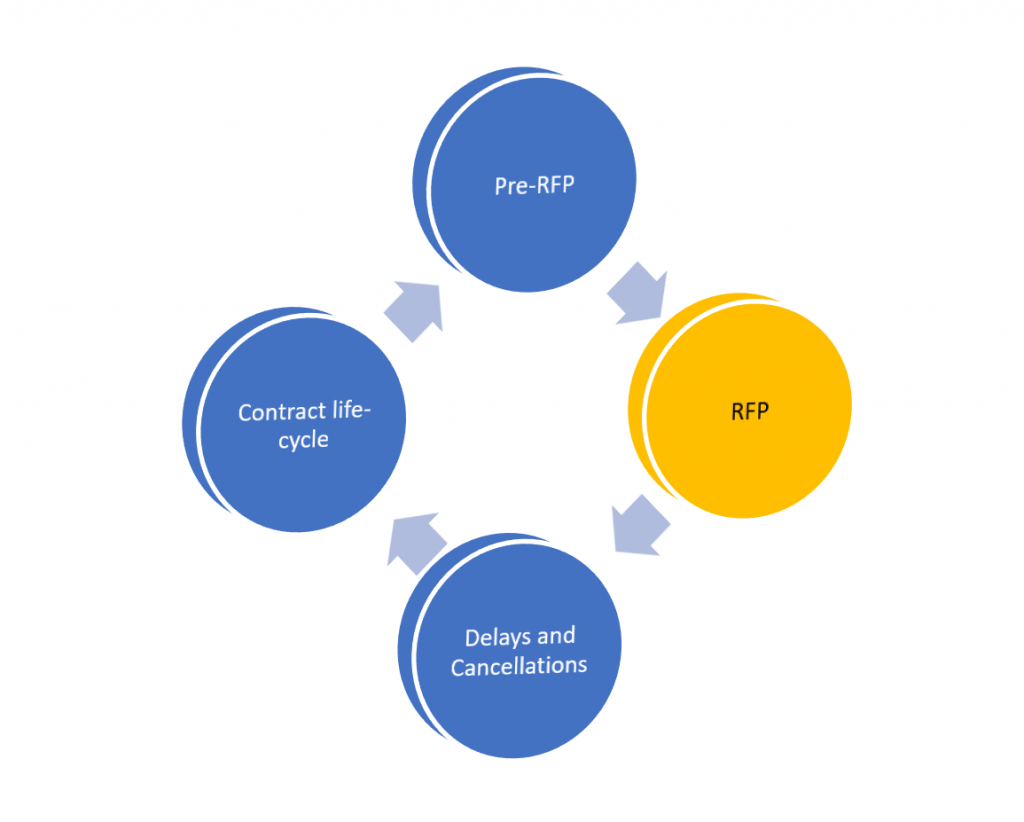

The Main Stages of the Typical Procurement Cycle

The Medicaid sales cycle can be broken down into 4 main stages as shown in this diagram:

Detecting opportunities pre-RFP

The single most important part to get right

It is important to detect procurement opportunities before an official request for procurement is announced for 3 main reasons:

- By the time the procurement is announced it may be primed for a specific vendor

- Early detection places you in an advantage for proposal preparation (bidders often have less than 30 days to prepare large proposal packages)

- If you detect an opportunity early enough, you can provide input into the overall strategy

The RFP Stage – Expect the unexpected

Duration of RFP periods

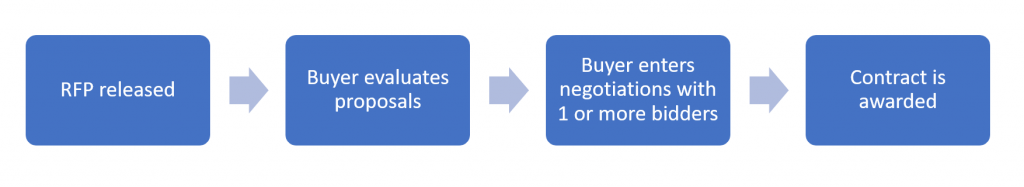

While RFP timelines vary for each procurement, a typical RFP in the Medicaid space will take about 3 to 6 months from the time the RFP is released.

The major stages are:

- RFP is released, proposals are prepared– You should plan on about 30 days for the time allowed to respond to an RFP.

- The buyer (state or health plan) reviews submitted bids– Initial decisions take another 30 days or longer. If there are multiple bidders who make it past the initial vetting, this stage can take longer and evolve into an extensive best-and-final offer (BAFO) model.

- The winning bidder and the buyer establish the actual contract- Contract negotiations add another 30- 60 days. Buyers often select 2 vendors to enter preliminary negotiations with, and this stage can add additional time and revisions.

Besides the normal timelines observed, there are other ways more time can be added to the process. One of the most common ways this can happen is through the vendor Q and A process. When buyers collect questions from vendors, there are often items of scope that are clarified or changed. In some cases, the buyer will issue an addendum which can allow for more time to accommodate the change in proposals.

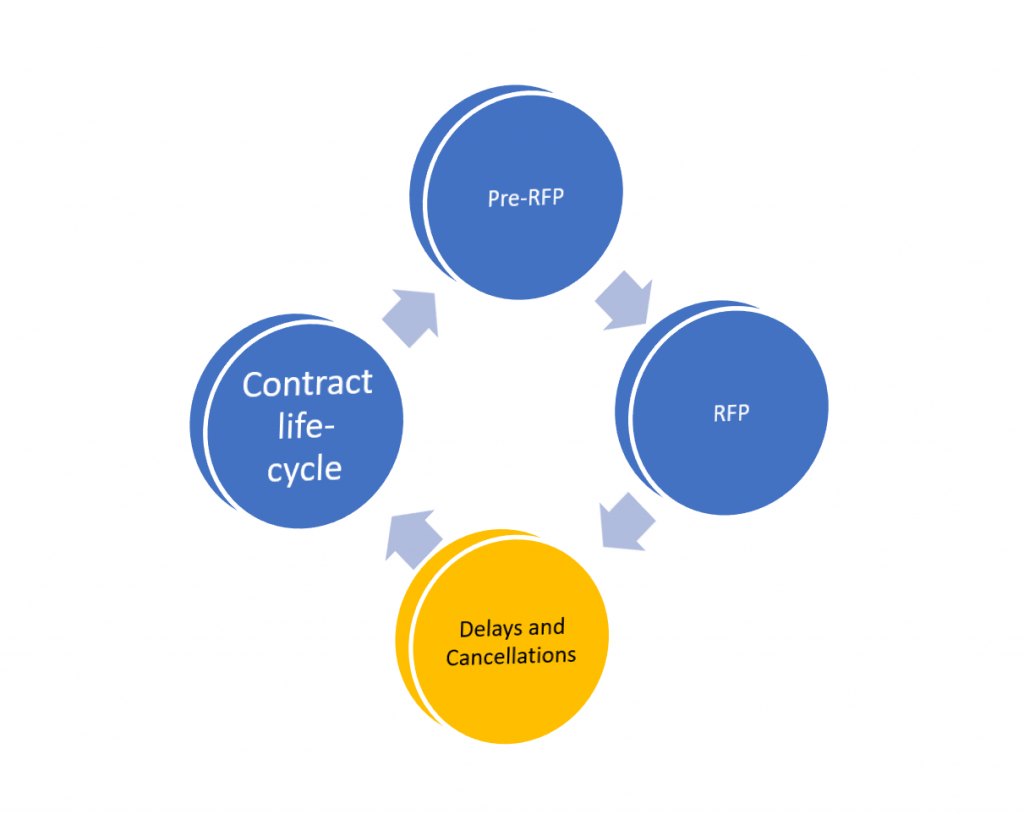

Delays and cancellations

It happens more often than any of us prefer

Delays can be caused by many factors, including:

- CMS approvals take longer than expected (for the federal share)

- The vendor review and approval process takes longer than expected

- BAFO / contract negotiations takes longer than expected

Cancellations can happen for a variety of reasons, including:

- Budget authority may be pulled by the state legislature

- Another program initiative takes priority

An incumbent offered the solution as part of an amendment to their existing scope

How You Can Optimize Your Sales Capture Approach to the Unique Medicaid Industry Sales Cycle

In addition to your own research into this vertical, there are a few key tactics that can help you overcome some of the common challenges in the space.

- Target your capture strategy to the appropriate Medicaid path-The tactics used in the 2 major paths are very different, and it is important to prioritize based on which path you feel is right for your near and long term goals. If your value proposition is refined enough, it should be clear which path is best. The maturity of your solution can also help guide this choice.

- Engage a firm with deep expertise and extensive contacts in the space to accelerate your efforts and train sales staff. We provide this type of assistance to our technology solution vendor clients, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

- Improve your ability to surface opportunities before they go out to bid- In Medicaid, you must know each state market in-depth to be able to identify opportunities earlier. If you have an in-house market intelligence team, they can track state budget bills and legislation. They can research MMIS contract cycles to gauge when large changes to technology spending will occur. On the managed care side, your team can stay on top of Medicaid waiver applications with CMS to predict when plans may need help with new scope. You can also research MCO contracts to understand key timelines. Your team can review EQRO reports and related PIPs to identify specific pain points for an MCO. We also provide state-level tracking for opportunity detection for clients, and are happy to discuss at any time.

- Consider adding a Medicaid-specific sales intelligence product to your toolkit. While there are multiple options for general sales intelligence in the healthcare space, if you are considering (or already executing) a sales strategy tied to Medicaid or HHS-vertical revenues, the more specific your research sources, the better. Our HHS GreenBook combines extensive RFP collection with copies of incumbent proposals, contracts and in depth state market profiles.

Related Products

What are the key differences between Medicaid and other payer spaces from a pharmaceutical manufacturer perspective?

Many of our clients are pharmaceutical industry professionals working to increase access for Medicaid members to drugs, devices and therapies. These clients include manufacturers, PBMs and other organization types. The article below is based on our experience working with professionals who have successfully navigated this space. Concepts have been simplified for clarity.

Reading time: 7 minutes

Intended Reader: Pharmaceutical manufacturer sales executives and marketing teams

Key Topics: The state by state nature of Medicaid programs, How PBMs are different in Medicaid, Variation across P&T committees

The State-by-state Nature of Medicaid Programs

One of the first differences pharmaceutical professionals notice is the uniqueness of each state Medicaid program. While there are national dynamics in play with some of the larger rebate programs, each state has a large degree of control over its coverage and reimbursement policies.

The main variables for a given state market include:

- Fee-for-Service– How does the state handle drug coverage for members who are not in a managed care plan? Are some drugs covered under FFS but others are not?

- Managed Care– What responsibility and authority do health plans operating in the state have for pharmacy benefits? For plans that are part of national brands, how centralized are those decisions?

- Collaborative Care Models– In recent years, some states have implemented these models. In these models, benefit decisions are often made by a board. Examples include CCOs in CO and WA.

State laws and regulations– Each state will have a different set of regulations on how coverage decisions are made, benefit categories products will be assigned to, and how marketing and communications can be done for members about pharmaceutical benefits.

Use of Pharmacy Benefit Managers in the HHS Space

While pharmacy benefit managers (PBMs) are not unique to the Medicaid payer space, recent trends have shown the importance of understanding the impact the state government context has on PBM activities.

There are 3 key considerations for manufacturers evaluating the role of PBMs in Medicaid:

- The PBMs goal of conserving public funds– Since Medicaid is funded with both federal and state tax dollars, spending on pharmacy has a high degree of visibility. This is most apparent during the annual budget process in a given state. There is generally more scrutiny on PBM activities in the Medicaid space because of the ongoing need to show cost savings with public funds.

- The expanded scope of PBMs in the Medicaid space– Compared to PBMs in other payer spaces, Medicaid PBMs often take on extensive program management scope, including clinical drug reviews for states to inform decision-making (i.e., states outsourcing some P&T-type functions to PBMs). Medicaid PBMs also negotiate Medicaid supplemental rebates.

- Recent concerns around transparency – While states have increased reliance on PBM services in recent years, there has also been some scale-back in certain state markets. This retraction is largely over spread pricing issues. There is a renewed call for transparency in PBM operations, and a new political focus on contracts.

Variation in Structure and Operation of P&T Committees

Federal law requires each state to have a P&T committee if the state wants to operate a Preferred Drug List (PDL). Each state must include physicians and pharmacists on the committee- but beyond this general requirement, each state can set its own procedures and schedules for the activities and decisions of the committee.

While states must cover any drugs on the federal Medicaid rebate program, coverage for other drugs is up to each state (or health plan if the state has delegated this to managed care). There has been a trend towards adopting more uniform PDLs for specific drug classes (in 2018, 14 state Medicaid programs had a uniform PDL)[1]. Some states have also moved towards streamlining medical neccessity criteria with uniform clinical protocols.[2]

While these trends toward standardization have been observed, wide variation by states is the norm.

Some states require utilization controls (such as prior authorization) for all new drugs before a P&T committee develops specific rules. Some states have rapid evaluation processes, but others have extensive protocols that can include pilots, meta-analyses and extensive expert review. These processes range from three months to one year for consideration of new drugs or newer / improved coverage for an existing drug. Like all things government, there is a political nature to the coverage and pricing in many Medicaid pharmacy programs that needs to be taken into account when addressing market access issues in a given state. In many states, the level of influence that the independent pharmacists association exerts can be the difference between coverage, or limited coverage with extensive controls. The role of advocacy organizations whose populations are impacted by your product is also often significant.

How You Can Address the Challenges and Complexities of the State Medicaid Pharmaceutical Environment

Besides your own research into this topic, there are a few key tactics that can help you overcome some of the common challenges related to improving market access in Medicaid markets. We assist clients with each of these strategies, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

- Train your account teams on the details of each state Medicaid program they call on. Knowing the fundamentals of each state program is critical. Most teams used to the commercial space are initially unaware of this need in Medicaid, and then quickly become overwhelmed by the learning curve.

- Ensure your sales decks and messaging are aligned with the unique values and priorities in the Medicaid payer space. Telling the right story to a Medicaid audience is completely different than the normal narrative for commercial and Medicare Advantage audiences. Your sales collateral needs to account for the unique needs and perspectives of Medicaid program decision makers.

- Evaluate what your traditional government affairs approach can and cannot do to help in the Medicaid space. Many manufacturers have a government affairs presence in multiple states. However, traditional government affairs approaches are often insufficient because of the complexity of players, advocates, and the economics of Medicaid financing.

- Set realistic expectations of timelines in your sales planning– Increasing access for a drug in the Medicaid space can take years. While the volume of members in the Medicaid space can drive significant revenues, there is usually a significant time investment, sometimes multiple years, before favorable coverage policies are fully realized. If you do not set appropriate expectations internally, you will create disruption and confusion in your sales organization.