MM Curator summary

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

[MM Curator Summary]: Specialty drugs continue to drive Medicaid drug spending, and its getting faster, with 2021 being the first year an increase this size has been seen in overall Medicaid Rx spending.

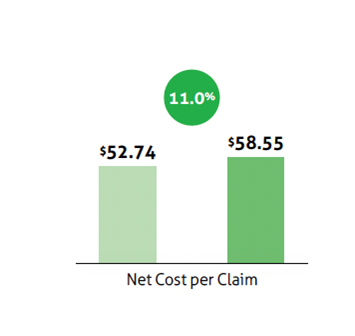

Spending on specialty drugs fueled a 11% increase in Medicaid drug spending from 2020 to 2021, says Magellan’s seventh annual Medicaid Pharmacy Trend Report.

Net Medicaid drug costs increased by 11% from 2020 to 2021, according to Magellan Rx Management’s Medicaid Pharmacy Trend Report, which was published earlier today. It is the first time during the seven-year history of Magellan’s report on Medicaid drug expenditures trend that the increase has been in the double digits, according to the report.

As is true for drug spending for almost all payers, specialty drugs — expensive drugs for rare disease — are accounting for a growing share of Medicaid drug spending and the year-to-year increases in spending, or “trend,” according to the Magellan.

Source: Magellan Rx Management Medicaid Pharmacy Trend Report, 7th edition

The report says the specialty net trend rose 2.1 percentage points from 10.9% in 2020 to 13% in 2021 while the traditional net trend rose 4.1 percentage points from 1.9% to 5.8%. In 2021, specialty drugs accounted for small fraction of drug claims — just 1.3% — but for the majority — 53.8% — of the net drug costs, according to the Magellan report. That is a 2.3 percentage point increase from 2020 when specialty drugs accounted for 51.5% of total net drug costs.

Net costs are often used analysis and calculations of Medicaid drug costs because the difference between the gross and net spending is so large. Medicaid programs receive in a mandatory 23.1% rebate from manufacturers and additional rebates for many drugs on top of that mandatory rebate. According to the Magellan’s numbers, the net cost per claim in 2021 was $58.55, or just 41% of the gross cost per claim of $142.18.

Magellan’s report is not based on drug prices and spending for all Medicaid programs. Rather, the report is based on data for the company’s fee-for-service pharmacy programs in 24 states and the District of Columbia. The report says the data set used to prepare this report included 95 million claims with a gross cost of $13.6 billion and a net cost of $5.6 billion.

Late last year, Prime Therapeutic finalized the $1.35 billion acquisition of Magellan Rx, the pharmacy division of Magellan Health, from Centene Corporation.

The report identifies the specialty drugs most responsible for the increase in spending on specialty drugs. Topping the list are Hemlibra (emicizumab), a treatment for hemophilia A treatment; Trikafta (elexacaftor, tezacaftor, and ivacaftor), a treatment for cystic fibrosis; Evrysdi (risdiplam), a treatment for spinal muscular atrophy; Biktarvy (bictegravir, emtricitabine, tenofovir alafenamide, an HIV treatment; and Stelara (ustekinumab), a treatment for plaque psoriasis, Crohn’s disease and ulcerative colitis.

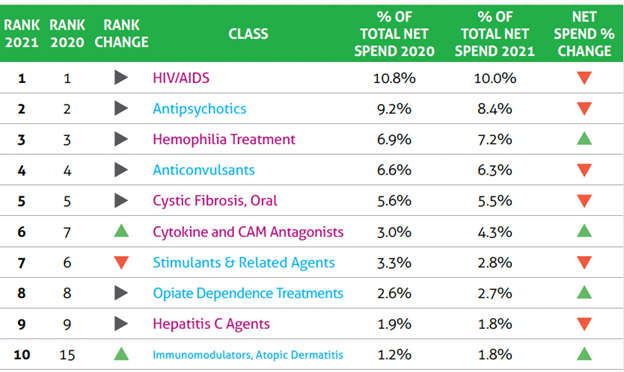

The report also ranks 50 drug classes by their share of the net spend in 2021. Drugs for HIV/AIDs ranked the highest, accounting for 10% of the net Medicaid spend in 2021. They were followed by antipsychotics (8.4%), hemophilia treatment (7.2%), anticonvulsants (6.3%), oral cystic fibrosis drugs (5.6%) and cytokine and CAM (cell adhesion molecule) antagonists (4.3%), a group that includes Stelara and Humira (adalimumab).

Source: Magellan Rx Management Medicaid Pharmacy Trend Report, 7th edition

Drugs for spinal muscular atrophy, a group of inherited diseases that damage and destroy motor neurons, was further down on the list, ranking 13th and accounting for 1.5% of the net spend. But the report says that claim volume increased by 425% as prescriptions for Evrysdi increased and the market share of Spinraza (nusinersen), delivered via an intrathecal injection, shrank.