The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

COVID has led to a 9% decrease in MLR for Medicaid health plans.

Original Report:

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

COVID has led to a 9% decrease in MLR for Medicaid health plans.

Original Report:

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

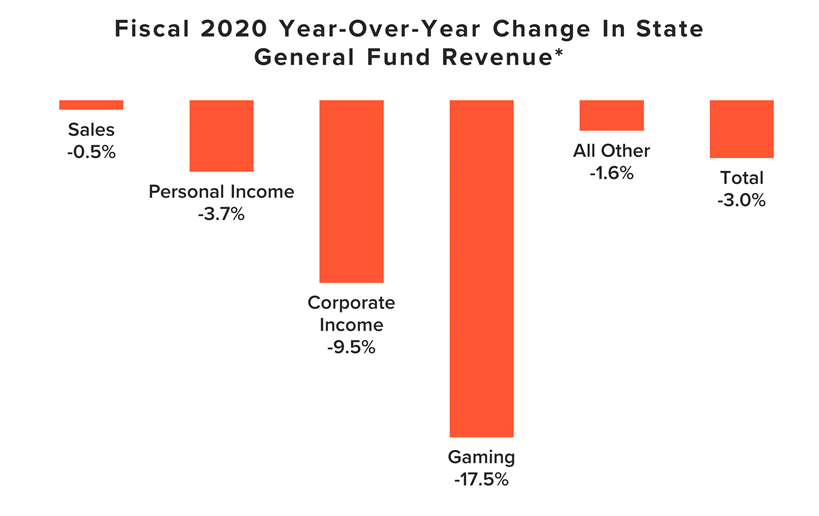

State revenues were projected to increase in the previous survey- but now they have taken significant hits due to COVID. General fund revenues are now at 6% below where they were projected to be. Gaming revenues have taken the largest hit, with 17.5% YOY decline.

Clipped from: http://budgetblog.nasbo.org/budgetblogs/blogs/shelby-kerns1/2020/09/08/state-revenues-decline-for-first-time-since-the-gr

The majority of states have closed out fiscal 2020 and, as expected, most states experienced a decline in general fund revenues, both compared to prior-year (fiscal 2019) collections and to pre-COVID revenue projections. This large swing in tax collections led to a roughly 6 percent shortfall for states for fiscal 2020 in just a few months’ time. This initial decline is only the beginning of what is projected to be a multi-year revenue challenge facing states with the potential to dampen the economic recovery. As states continue to experience high unemployment rates and lower consumption levels, the trends seen in the fourth quarter of fiscal 2020 are expected to further depress state revenues in fiscal 2021 and beyond.

Based on a survey of states and territories, general fund revenues are showing year-over-year declines for fiscal 2020 compared to fiscal 2019, as shown in the chart below.

Note: Some states reported estimates for fiscal 2020, as preliminary actual data were not yet available.

* The figures reported above only include states that operate on a July to June fiscal year, as these states all experienced a similar period of COVID-19 impact on their fiscal 2020 revenues. The states that do not operate on this cycle include New York (fiscal year starts on April 1), Texas (September 1), Alabama and Michigan (October 1), and New Jersey (only for fiscal 2021, October 1).

An unusual circumstance impacting fiscal 2020 was the delay of the federal tax filing deadline. Most states extended their tax filing deadlines to conform with the federal government, which resulted in 19 states counting revenue in fiscal 2021 rather than fiscal 2020. Among those 19 states, 17 states were able to report preliminary or estimated amounts for those deferrals. If we account for those filings in fiscal 2020, the revenue comparisons improve slightly but continue to show the same troubling trends, especially when one remembers that the COVID-19 crisis only affected revenues for the last few months of the fiscal year. After adjusting fiscal 2020 revenues to include these deferred amounts, total general fund revenues declined 1.6 percent compared to fiscal 2019, with personal income taxes declining 1.1 percent and corporate income taxes declining 6.8 percent.

As reported in NASBO’s Spring 2020 Fiscal Survey of States, before the COVID-19 crisis, states were estimating general fund revenue growth of 3.0 percent. Instead, this preliminary data shows revenue declines for fiscal 2020 of 3.0 percent, resulting in a roughly 6 percent general fund revenue gap for states, on average. States budgeted based upon forecasted tax collections, so these revenue losses left a sizeable budget gap for states to close, requiring them to take actions including spending cuts to core services such as education. Even some states that ended fiscal 2020 with general fund revenues up slightly year-over-year had to make budget cuts or turn to reserves, since they still fell short of projected tax collections. Deeper cuts will be necessary in fiscal 2021 and 2022 as budget gaps grow wider due to an expected continued decline in revenues and rising expenditure pressures from the public health crisis, economic downturn, inflation and population growth.

States are expected to see the impact of COVID-19 on their revenues for years to come. While most states saw revenue decreases in fiscal 2020, state revenues are expected to see more severe declines in fiscal 2021 than they experienced in fiscal 2020 for several reasons:

For the reasons outlined above, state revenue forecasts for fiscal 2021 (and fiscal 2022 for those states that have released estimates) are projecting more significant losses, especially without additional federal aid. Overall, state revenue losses resulting from the COVID-19 recession are expected to exceed the 11.6 percent drop states experienced over two years during and following the Great Recession, with some states anticipating revenue declines of 20 percent or more. Moody’s Analytics released an analysis on stress testing state budgets based on its latest economic forecasts, which estimates budget shortfalls through fiscal 2022. According to that analysis, state budgets could experience a fiscal shock (revenue declines plus increased Medicaid expenditures) of $498 billion due to a prolonged economic recovery and continuation of COVID-19 cases in the fall. This analysis assumes flat spending by states with no increases to combat the epidemic or address other needs.

States have already begun making budget cuts in response to these forecasted revenue declines, and more adjustments are expected. Numerous states that enacted budgets for fiscal 2021 based on pre-COVID revenue forecasts have called special sessions to revise those budgets, eliminating pay increases and making cuts to baseline spending and personnel. Meanwhile, states that passed budgets after the onset of the COVID-19 crisis similarly cancelled planned investments, implemented furloughs and other actions, and cut base spending. Many governors and their administrations have directed agencies to develop contingency plans to reduce their budgets, for fiscal year 2021 and/or fiscal year 2022, by as much as 15 or 20 percent.

This analysis is limited to general fund revenue impacts only, and therefore does not show the full magnitude of revenue loss facing states. States are also seeing significant losses and ripple effects in other critical revenue streams, such as gas taxes and various program user fees, due to the public health crisis. These revenue sources are typically less vulnerable to the economic cycle, but the COVID-19 pandemic is not a typical recession.

State and local governments are major economic drivers. Their spending totaled $3.1 trillion in 2019, representing 14.7% of gross domestic product. As states continue to experience high unemployment rates, the trends seen in the fourth quarter of fiscal 2020 are expected to further depress state revenues in fiscal 2021 and beyond. Without additional federal aid to mitigate these revenue losses, states will be forced to make deeper cuts to services and spending, as well as turn to tax increases, creating a drag on economic growth at a time when the nation’s economy is attempting to recover.

This 106-page doc includes a rich data set of outcome measures in the Medicaid population, including:

Curator, Managed Care, North Carolina

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

NC managed care now is required to move forward by the legislature by July 2021, though protests/ lawsuits are still pending.

Clipped from: https://www.northcarolinahealthnews.org/2020/09/29/medicaid-managed-care-companies-take-protest-to-court-again/

In the middle of a coronavirus pandemic that has tossed up challenge after challenge, the state Department of Health and Human Services also must tend to another enormous project.

Over the next 10 months, the department has been told by the legislature to complete the transformation of its cumbersome Medicaid system.

In the current system, the state pays for each office visit, test and hospitalization for the seniors and children enrolled in Medicaid. By July 1, North Carolina is expected to launch a managed-care system in which private insurance companies get lump-sum payments from the state to pay providers for their overall care of most of the state’s 2.3 million beneficiaries.

North Carolina lags behind the rest of the country in making this switch and the changeover has been touted by Republican legislators as a potential cost-saver for the state.

As DHHS staff tend to the details of the massive switch of how some 1.6 million Medicaid patients will get health care, companies that lost out on bids for a share of the more than $30 billion the state will dole out over the next five years are stepping up their challenges in court.

In late August, an administrative law judge ruled against Aetna, Optima and My Health By Health Providers, companies that argued DHHS unfairly awarded Blue Cross Blue Shield of North Carolina a contract.

My Health By Health Providers, a consortium of major hospital systems in North Carolina, petitioned a Wake County Superior Court judge this week to reverse that decision.

In the court document filed on Sept. 23, the provider-led entity, or PLE, argued that the contract awarding process gave a weighted bias to traditional insurance companies over the 12 health systems that have joined together as My Health By Health Providers.

They argue that their owners, which already serve more than 1 million Medicaid beneficiaries each year, are in a better position to provide the managed care, in part, because they are in North Carolina and familiar with the health needs already.

They are troubled that the judge issued a ruling in summary judgment, a step that precluded them from presenting their entire body of evidence in a hearing.

Lisa Farrell, executive director of My Health By Health Providers, said her organization was only before the administrative law judge for two hours of arguments.

On Monday, she ticked off a few reasons why she thought the DHHS process was rigged against PLEs from the start. She also explained why My Health By Health Providers is continuing its challenge in Wake County Superior Court instead of trying again when the procurement process opens again.

It’s best to be in on the ground-level, she said.

“One of the considerations as you go forward is members will establish themselves,” Farrell said.

Though My Health By Health Providers was the highest PLE scorer in the bidding process, the state argues that it was looking for a regional plan and the conglomeration of health care systems had pitched a statewide plan. The 2015 law mandating the Medicaid switchover stipulates that PLEs can bid for business in a region, or two contiguous regions, but doesn’t say anything about PLEs bidding for all of the state’s regions.

Farrell argues that My Health By Health Providers’ bid also offered regional options.

While explaining why she thinks PLEs are needed in North Carolina to complement and challenge the managed care that traditional insurance companies provide, Farrell gave an example of a pediatrician in rural North Carolina treating a child with a complex illness.

The health care systems comprising My Health By Health Providers include Atrium Health, Cape Fear Valley Health, CaroMont Health, Cone Health, Duke Health, Mission Health, New Hanover Regional Medical Center, Novant Health, UNC Health, Vidant Health, Wake Forest Baptist Health, and WakeMed Health and Hospitals, some of which are connected to academic research centers.

With that connection, the rural provider could get the patient quickly linked to a health care facility that could provide the more complex care, Farrell argued.

“Providers, because they are providing the care, are really closer to their beneficiaries,” Farrell said.

The state’s selections for the coveted managed-care contracts were announced in February 2019. The awards went to four well-established insurance companies: AmeriHealth Caritas, Blue Cross and Blue Shield of North Carolina, UnitedHealthcare and WellCare. Carolina Complete Health, a provider-led group that will be run by Centene, a managed care giant, was the sole provider-led entity selected. The N.C. Medical Society backed that plan.

In challenges that started last year in the state Office of Administrative Hearings, My Health By Health Providers, Aetna and Optima Health, another provider-led group linked to Virginia’s Sentara Healthcare, argued that DHHS employees involved in the contract awarding process had conflicts of interest that caused them to favor BCBSNC over their bids.

The state and BCBSNC have disputed those claims, and on Aug. 25, Tenisha Jacobs, an administrative law judge, sided with them, ruling that the contract had been properly awarded.

DHHS issued a statement several days after the decision.

“The NC Department of Health and Human Services (NCDHHS) is pleased to announce that once again court rulings affirm the integrity and fairness of the Departments’ managed care procurement process,” according to the statement.

Jacobs heralded the possibility of such an outcome in a June 2019 ruling before the companies had presented all their evidence. They had asked her to halt the Medicaid system transformation while their court cases remained unresolved.

Though Jacobs ruled against the request, saying the companies seemed unlikely to succeed on the merits of their claims, the transformation was instead put on hold in late 2019 because of a budget standoff between Gov. Roy Cooper and Republicans leading both General Assembly chambers.

The transformation had been scheduled to begin in February of this year, but the General Assembly closed its 2019 session without a budget that dedicated funding to the project.

This summer, the General Assembly set a new deadline. Lawmakers considered penalizing DHHS if the transformation did not occur by July 1, raising the possibility that the department could be charged millions of dollars for each month after that date that the launch did not occur.

Eventually, the bill that passed did not include penalties.

“North Carolina’s approach to managed care has received national recognition and focuses on improving the health of North Carolinians through an innovative, whole-person centered and well-coordinated system of care that addresses both the medical and non-medical drivers of health,” according to the DHHS statement issued in August after the ruling.

Aetna immediately appealed the August ruling in Wake County Superior Court.

“For the past 18 months, Aetna Better Health has dutifully followed the Office of Administrative Hearings’ (OAH) protest process in our protesting the North Carolina Department of Health and Human Services’ (DHHS) awarding of contracts for prepaid health services regarding the state’s Medicaid program on several grounds, including, but not limited to, conflicts of interest between DHHS and certain awarded carriers, changes in the scoring process by DHHS to benefit certain awarded carriers, and DHHS’ attempt to conceal how scores were changed to benefit particular awarded carriers,” Aetna said in a company statement at the time. “After a year and half of protest with little progress, we are left no viable choice procedurally but to pursue our Medicaid protests against DHHS in Superior Court.”

Dave Richard, deputy DHHS secretary for NC Medicaid, said in an interview last week that while he’s confident in the process used to award the contracts, legal challenges were not unusual.

“I think we’re seeing that across the country that that happens,” Richard said. “No one wants to go through this process. It takes time from people, but we were always prepared that this is a possibility.”

As part of the legal defense, the department produced some 230,000 pages of documents and staff members had to sit through weeks and weeks of depositions.

“The judge ruled in our favor,” Richard said. “We believed she ruled correctly, and we have no reason to believe that there’ll be anything different that happens in the appeal.”

The challengers hope for a different outcome, arguing that they did not get to present all their evidence to the administrative judge.

Matt Salo, executive director of the National Association of Medicaid Directors, said the challenges in North Carolina are not unique, but all that litigation eventually might lead states to reconsider managed care systems.

“I appreciate that this is really important stuff, that this is big business, these are contracts that are very, very meaningful,” Salo said in a telephone interview last week. “But having said that, if we keep going on this trajectory, where everybody who doesn’t like the outcome, just resorts to the courts, and sues and has a bid protest, we’re going to end up in a world where states are just going to throw their hands up and say, ‘You know what, it’s easier if we just go back to fee for service.'”

Salo did not speak specifically about the North Carolina cases, but acknowledged that some companies that lose out on contracts might have legitimate concerns that should be litigated.

In Louisiana, contracts worth billions of dollars were thrown out in January after the state’s chief procurement officer determined the health department had mishandled the bidding process.

Two losing bidders helped reveal the problems in challenges filed by Louisiana Healthcare Connections and Aetna Better Health, which banded together to complain of conflicts of interest, a skewed process and improprieties.

“There can be a role for a protest, you know, if something serious has gone wrong, if there was a serious mistake that was made, and sometimes that happens,” Salo said. “You know, it’s important to have an outlet. …There are legitimate protests. And if that’s the case, you should do it.

“What I’m worried about is the trend where it’s just, it’s just a knee jerk reaction of ‘I didn’t like the option. So, I’m escalating to the next step.'”

I am currently working in the healthcare delivery segment, providing direct pediatric physical health services via telehealth in both school and at home. My primary focus is on the collaboration with Medicaid payers to support Medicaid eligible populations in accessing care where they feel safe and supported and to close gaps in care. We work to provide a seamless integration between children, the healthcare system and education by adapting and working to find solutions.

I have been working both directly and indirectly in the Medicaid industry for the past 6years. My initial experience with the Medicaid was as a case manager for both the geriatric population and for children with Autism Spectrum Disorder. I was able to experience first-hand the complexity of delivering care within these populations and eventually worked at Nevada Medicaid. I started my tenure at the State as a policy and program specialist within medical programs and eventually served as Chief. During my tenure, I was able to successfully work with CMS to change our State Plan for free care reversal and tribal FQHCs. This work was incredibly rewarding and working with Hazel has allowed me to have the opportunity to work on the implementation side of the school-based policies.

I am passionate about bringing equity in healthcare and education to children. I am so fortunate that my career is aligned with my passion. I grew up in an impoverished area in Las Vegas and I have witnessed first had the impact that this can have. As leaders in the industry, we must truly keep a keen eye on how to make the lives of our future generation better.

Post pandemic, my bucket list will be filled with travel and new experiences. Since that is not feasible at the moment, I have been focused on traversing as many trails as possible around Lake Tahoe where I reside. There are a lot of incredible hikes, lakes and wildflowers to see in the area and I don’t want to look back with regret that I didn’t make the most of them. I think right now there is so much value in finding pleasure in the moment and slowing down just a bit.

Most of all, I enjoy my family. I have four incredible daughters and a granddaughter. They bring so much joy and insight into my life. Time spent with them is invaluable. I also really enjoy being active and I read all the time. I like my personal time to be a place of growth and exploration.

That’s a tie between Maya Angelou and Rosa Parks. I admire Maya’s clarity of thought and inspiration that she brings to the world. Rosa had so much courage in the face of adversity and made such an impact during the civil rights movement. Both women came up through adversity and made changes to the world. They are both heroes.

Ice cream. Hands down. I love all of the unique flavors and artisanal approaches. Growing up in an Italian family, spumoni would be my all-time favorite. I loved going to Thrifty as a kid and getting the cool cylindrical shaped scoops of butter pecan. We didn’t have much money growing up, but we could always scrape out the15 cents for a scoop. These are such strong, happy memories from my childhood. I just always remember laughing and life feeling perfect in these moments.

I am incredibly proud of my four daughters. They provide more meaning and value in my life than anything. I continually try to carve a path so that they will have amazing futures. I just finished my second master’s degree in six years, both with a 4.0 and honors and working full time. I have to admit I am proud of that accomplish as well. Education and knowledge are so incredibly valuable and a gift not to be taken lightly.

Honestly, I don’t want any mulligans. I have learned more from my mistakes even when they are painful and I wish there was a do-over. It’s the ability to be scrappy, pull it together and move forward that builds your character and resistance. It’s all about progress. I gave up trying to be perfect a long time ago.

The importance of Medicaid is more critical and even more complex than ever right now. We are going to see a surge in enrollments amidst budget cuts and changing methods of healthcare delivery. We are going to have to be thoughtful in our approaches and work together in truly addressing the needs of our communities. This is not a time of self-serving interests, but to be givers and not takers. We will need to be mindful in our approaches of supporting healthcare business practices while ensuring that recipients are able to receive the care they need. We will need to move and change quickly but with intelligence and think outside of the standard ways of delivering Medicaid services.

Telemedicine. Specifically school based telemedicine.

Since my training started in the Bronx. 21 years.

To leverage technology to provide quality care to families who need it the most.

Go fly fishing in the South Pacific Ocean.

Spending it with my family. I have 2 daughters, one going to college this year and another one close behind. I am treasuring the few years I have before they leave our home.

Martin Luther King Jr. A man who changed civil rights through peaceful disobedience. That took truly amazing courage.

Nachos with all the toppings and extra jalapeños. It doesn’t qualify as ‘junk’ but I can’t validate it as an everyday meal.

Raising 2 smart, motivated young women who want to make their community better.

US Swimming Olympic Trials in1996. I was seeded 4th going into finals and let the pressure of the moment get to me. I wish I just enjoyed the moment instead of worrying about failure.

Discovering what high quality of care was delivered during the pandemic. How did telemedicine help Medicaid patients. What are the most glaring social injustices and medical gaps that were exposed for Medicaid patients and their families.

Here at ARC Healthcare, we focus on supporting the payers and providers, in addition to building robust and expandable physician networks. We help to build networks and identify areas in need of physicians. We then define them, vet them, get them onboard, and then we negotiate with them. We ensure that the Payers (i.e., Medicaid) and patients have access to adequate and quality care.

I have been in healthcare, including some Medicaid projects, for 15+ years.

My biggest passion is enabling patients and providers with the right information to make good sound decisions and to understand those decisions. Another passion is resolving the information disparity. The information disparity occur when patients and providers do not have the relevant information necessary to make healthcare decisions.

Helping patients and providers understand diagnoses and treatment options. Therefore, having the right information to make the right healthcare decision is necessary.

I play the bagpipes and like to spend time outdoors with our dogs.

Copernicus. He was one of the first scientists to use measurable data to argue a controversial point – the world isn’t flat.

Oh, that’s easy! Jellybeans and red licorice.

My three children. I am proud of a bunch of things, but I think I’m most proud of my children.

I don’t look back. I always reflect on mistakes and whatever, but there is nothing that I would say I would go back and re-do. I would learn from it and try not to repeat that mistake.

I think there is going to be a massive issue of how to provide medical coverage and provide services post-COVID-19. We are seeing lots of folks being laid off and losing their health insurance, so, naturally, you are going to see spikes in Medicaid enrollment. The primary question is, how do you provide coverage to those new enrollees, and then how do you ensure access to care? How will we ensure that our Medicaid networks can handle the increase of new enrollees and provide the quality of care that new enrollees are going to need?

I am currently involved in healthcare consulting with a focus on providing results-driven and solution-focused services and software recommendations to clients. We provide clients turnkey results that are meaningful, measurable and maintainable in contributing to overall quality and affordable care. Our goal is to ensure that clients are receiving the best value and up to date changes and innovations in the industry. We support our clients by providing solutions in the following areas:

i. Provider Network Development and Contracting Services to build a network(s) of qualified providers to address the needs of members and providers.

ii.Offer Outsourced Call Center Support by managing the large volume of calls from both providers and members to help them navigate new requirements, provide education and direction to properly access care.

iii.Use software solutions to create workflow efficiency, provide CRM support and manage provider network adequacy and streamline roster validation.

I have been in the Medicaid industry for over twenty-five years.

My focus and passion, in general, is service, personally, as well as professionally, to serve those who are underserved, the least, the last, the left out. I have a strong desire to serve and offer those who are subjected to healthcare disparities, not necessarily due to something of their own doing, but based on their plight in life, an opportunity to receive healthcare on par with those who can afford it. My focus is on serving them because I firmly believe that the best way to be a good leader is to serve.

I have never really had a bucket list until my mother passed in October. There were two places that she wanted to go that she had never been and I tried to take her there, but she got to the point where she was mobile enough to go to those places. Rhode Island is one of them, and the other is the Holy Land. I want to do that because they meant so much to her and because of that they also mean a significant amount to me.

I enjoy spending time with family. I get a lot of strength and energy from family, whether we are sitting in a room, just laughing and joking, watching a movie, or just talking about how our day went. Family means a significant amount to me and I am just very thankful for them and for every moment that we have together.

In the grand scheme of things, it is Jesus because of what he stood for. He was divine, but he was human, and he showed us how to live out humanity while relying on divinity to lead the way.

My favorite junk food is plain potato chips. It can be Lay’s or it can be the ones with the ridges. I can never stop at one.

The accomplishment I am most proud of is becoming the fulfillment of my mothers’ dreams. What I mean by that is, in the era that she grew up in, during the height of civil rights, and not having much opportunity for educational advancement, she always stressed the importance of completing high school and getting a college education, even though at the time she did not have that herself, she later went on to get her college degree, but she pushed me to do that long before, and although as I was matriculating through school at all levels and I was learning things that she didn’t know, she still realized the importance of what it meant for my future and just becoming the fulfillment of that is my proudest accomplishment because it set the stage for many others to follow.

This is quite funny to me, but my high school senior portrait. I had a lot going on and so much was happening that I forgot and it was at the end of band practice one evening that somebody brought it to my attention that it was the last day for senior portraits. There was no other time for me to take a senior portrait. I had just come out of the hot sun after 2 hours of practice and was not picture ready, but if I didn’t get the portrait at that time, I wouldn’t be in the year-book. It wasn’t the best portrait, so if I could do that over again, it would put a smile on my face.

The number one issue is being able to properly and effectively respond to what the new healthcare normal will look like post the COVID19 pandemic. It is important that we plan now for what’s to come otherwise, we will scramble to adequately provide and meet healthcare needs.

Number two is focusing on the quality of healthcare. It has become apparent through the effects of COVID19 that there are significant gaps in the quality and service of healthcare.

Number three is the focus on our preventive healthcare efforts, because when we focus on preventive measures, we can avoid things like the full onslaught of COVID19. While we may not avoid it happening, we can avoid the number of lives it reaches because by taking a preventive posture now. This is a testament to the Benjamin Franklin adage, “An ounce of prevention is worth a pound of cure.” Although he was addressing fire safety, the sentiments rang true for healthcare and many other life experiences. We can get messaging out sooner. We can raise the awareness of it. Tens of thousands of people had been affected and quite possibly died before we became serious about the messaging.

This video is part of our Summer 2020 Virtual Conference- Medicaid as the Most Important Part of the COVID 19 response. To learn more about our virtual conferences, including opportunities for patrons, please use the form below.

– After attending this session, attendees will understand the fundamental housing crisis that existed prior to COVID19, how it has intensified the needs, and illuminated the faults in the response system.

– Attendees will have examples of the intersection between stable housing, health, and other social factors.

– After attending this session attendees will know how they can prepare for the long term impacts of increased housing instability.

Amy Riegel